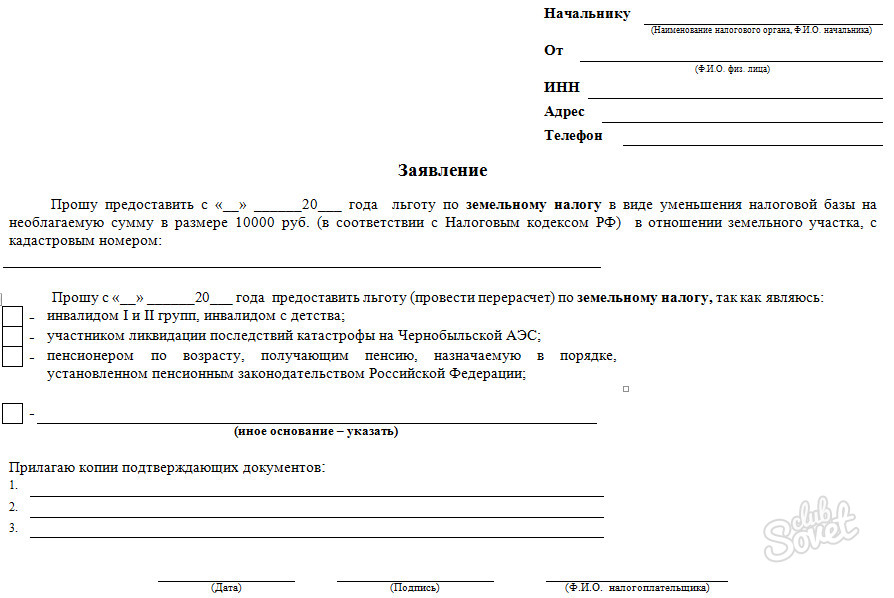

Application to its tax inspection should be carried out on a special form that will comply with the issuable issue.

Filling out the application, correctly and reliably specify all the data. In the upper right corner, enter the required data on your tax authority and yourself. After the document header, set out your request, based on the articles of the Tax Code. Next, specify a list of attached documents (if available). You can enable the desired method for obtaining the requested documents. Put the date and signature. The tax legislation is prescribed by the categories of citizens who have the right to claim tax deduction. Distinguish standard ( st. 218 NK RF), social ( article.219 of the Tax Code of the Russian Federation), property ( art.220 of the Tax Code of the Russian Federation), professional ( st. 221 NK RF) Tax deductions. Although in regulations and stipulated that such a statement may be made to the applicant in an arbitrary form, it is better to apply for a blank to its tax service. This will allow you to comply with a number of formal requirements and reduce the time of consideration of your documents. When buying an apartment by her husband and wife without distinguished shares (in general joint property), the spouses have the right to distribute the property tax deduction among themselves in any respect. For example, you decided to distribute the deduction in the 100: 0 ratio. The recipient of the damage due must apply with information on the decision. At the same time, your second half will not lose the right to get deduction in the future.

On our site you can download blanks and samples of completed applications to the tax:

Application form to tax inspection;

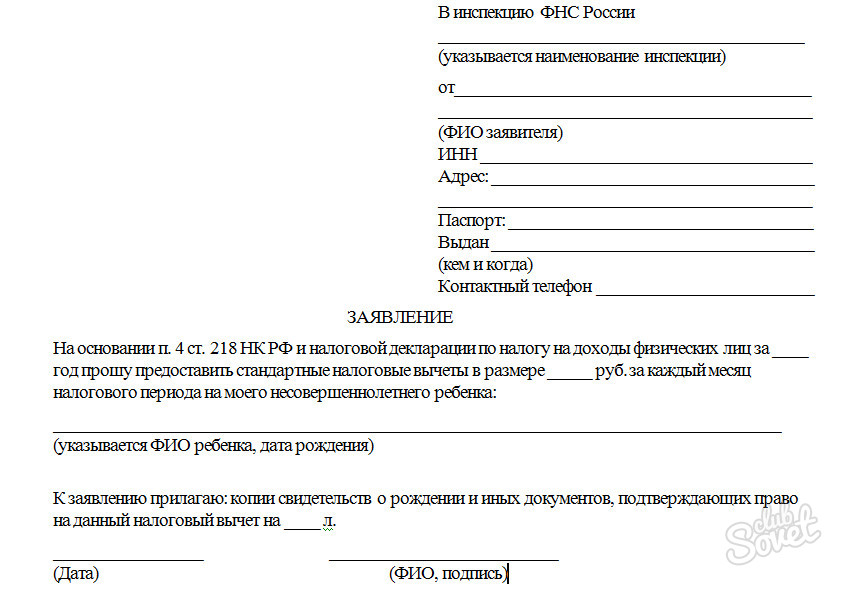

Application form to tax inspection; Application form for tax deduction;

Application form for tax deduction; Sample application for tax deduction;

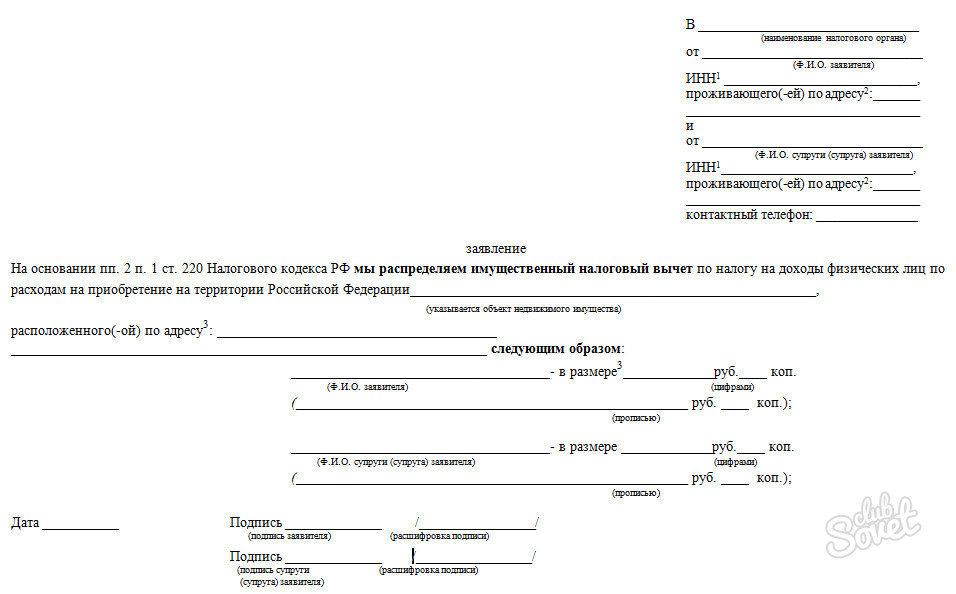

Sample application for tax deduction; Application form on the distribution of property tax deduction between spouses;

Application form on the distribution of property tax deduction between spouses; Sample application for the distribution of shares in total joint ownership;

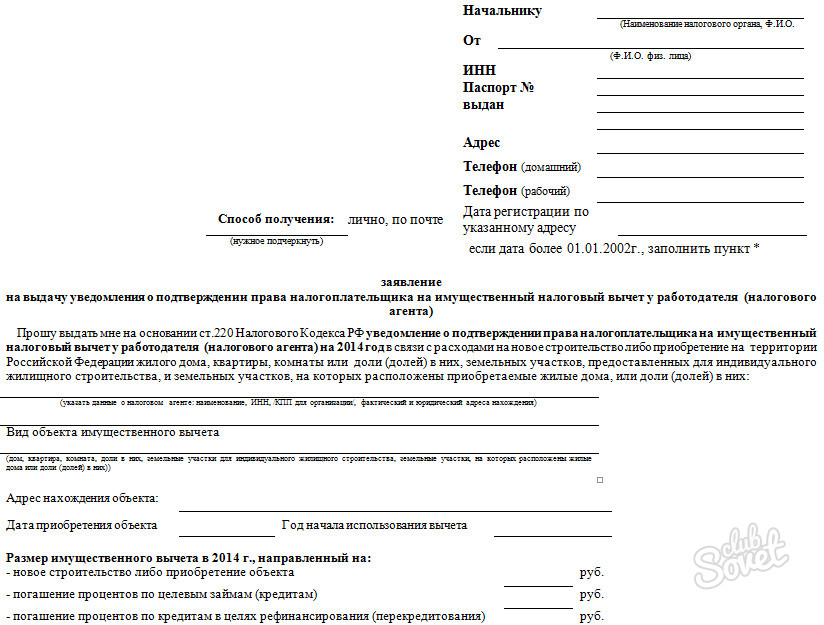

Sample application for the distribution of shares in total joint ownership; Application form for issuing a notice of confirmation of the taxpayer's right;

Application form for issuing a notice of confirmation of the taxpayer's right; Sample application for issuance of a taxpayer's confirmation notification;

Sample application for issuance of a taxpayer's confirmation notification; Application form for a refund (test);

Application form for a refund (test); Sample tax refund;

Sample tax refund; Application blank for property tax benefits;

Application blank for property tax benefits; Sample application for benefits for property tax;

Sample application for benefits for property tax; Application form for issuing certificates for taxes, fees;

Application form for issuing certificates for taxes, fees; Sample application for issuance of tax certificates, fees;

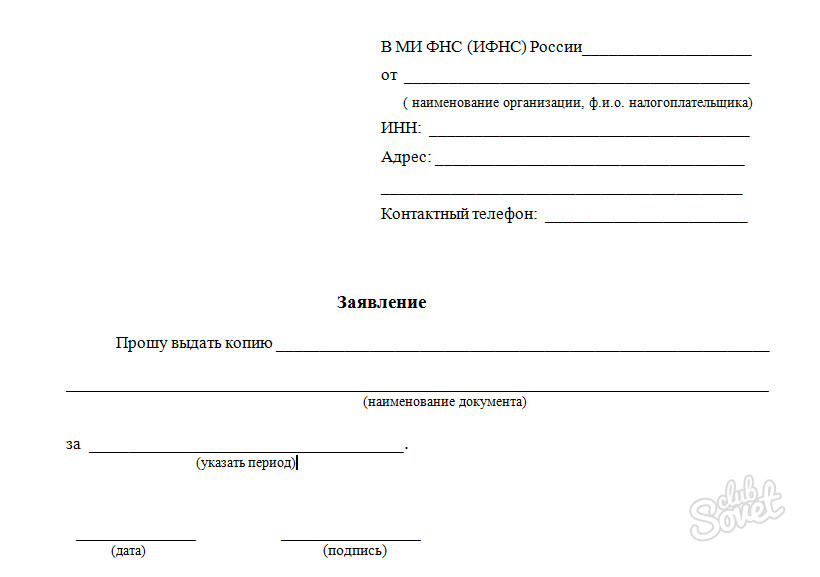

Sample application for issuance of tax certificates, fees; Application form for issuing a copy of the tax document.

Application form for issuing a copy of the tax document.

In each tax inspection hangs stands with sample documents. Choose the correct application form you will help the tax inspector.

Where did you find such forms?