How to fill in Help 2 NDFL

Each working citizen RF not ponaster sign with concept NDFL (tax on revenues physical persons or same income tax ), which the monthly employees accounting calculated with his wage fees , premium remuneration and others income v favor budget . Per dumed with salary employees money accountant carries a responsibility and reports front tax inspectors . For these goals exists installed the form 2 –NDFL . Our instruction will help to you right fill in this certificate and tell me some nuances process .

1

2 –NDFL fill one once v year for eVERY employee individually . V her display all taxes deductions with income working citizens per previous year . TO that income relate not only salary and prize , but and winnings , present , material help , revenues from sales property or delivery his v rent. on contractual based and t .nS . More detail familiarize sO all income , prices and not prices income tax , you you can v article 217 of the Tax Code of the Russian Federation .

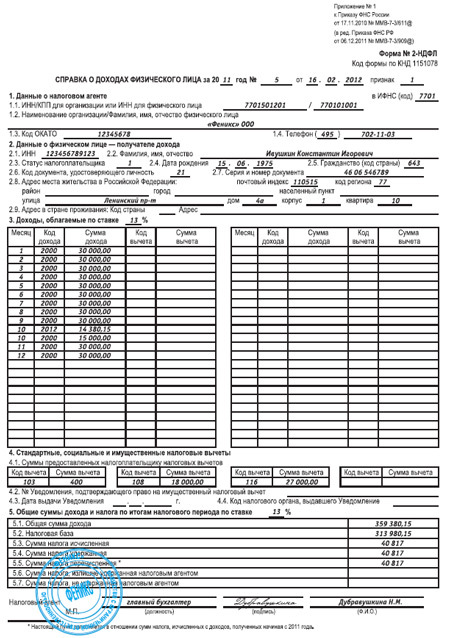

Reference form 2-NDFL here.

Example of reference 2-NDFL we have.

2

V very top certificates indicate year , v which charged income taxes , date fill and room samoa certificates . V graft “sign ” insert number 1 , if revenues per previous year climbed and number 2 , when tax hold impossible on what –then reasons . A to fill in field “v IFS. (code )”, necessary to know individual code you inspection , consisting from 4 figures , where first two show your region , a second two – code tax . This code can to know on website FNS. .

3

Now fill information about agent . When certificate fills physical face , then v paragraph 1 .1 we introduce only his Inn , a if organization , then necessary make KPP and Inn of this enterprises . V point 1 .2 enter full surname and name with patronymic agent or title firms , can v abbreviated video . Code OKTMO can to know on website FNS. . V point 1 .4 applied room telephone fill certificate , t .e. . agent .

4

In 2 paragraph applied information o employee , received income . V special field enter his Inn , date birth , full name . V field 2 .3 prescribed 1 , if employee – resident RF . V nasty case we write number 2 . To know accurate code countries can here . V field 2 .6 we are prescribed document code , on base whom take intelligence and enter v count 2 .7 . V graft 2 .8 necessary enter address registration employee how v passport . Count 2 .9 fill if employee not resident RF .

5

Starting to filling 3 parts certificates 2 –NDFL specified the size percent betting . V ours case she equal 13 %. Now fill table . V column “month ” we introduce room month , when was perfect pay . If v one month it was received several income , then their summarize it is forbidden . Each pay s described separately , a against assigns corresponding her income code . If produced deductions , then their also necessary make v table , specify code and sum .

6

Paragraph 4 filled if per year , per which the rEMOVED v help 2 –NDFL were received what kind –or deductions . Amount all deductions enter v table 4 .1 and specified their code . If speech gone about property sweeter , then necessary will fill in points 4 .2 , 4 .3 and 4 .4 .

7

Left fill in last paragraph 2 –NDFL under number 5 . V line 5 .1 let's point general sum all income per year . Line 5 .2 should contain tax base , that is an sum income (line 5 .2 ) reduced on sum all existing deductions (table v point 4 .1 ). V 5 .3 we offer sum tax , which the counted , a v line 5 .4 let's point sum restored tax . WITH 2011 of the year necessary fill line 5 .5 , where slipped sum tax , which already listed v budget . If when –or tax agent was hold big or lesser sum tax , then this is can adjust with help stitter 5 .6 and 5 .7 .

How see , possessing information o income , can easily fill in certificate on form 2 –NDFL on one's own , for example , for togo, to receive one-time or social deductions , for destination pensions or for receipt credit . Yet simpler can fill in this certificate , downloaded special program on website tax inspection .

VIDEO

![]() Reference form 2-NDFL here.

Reference form 2-NDFL here.![]() Example of reference 2-NDFL we have.

Example of reference 2-NDFL we have.