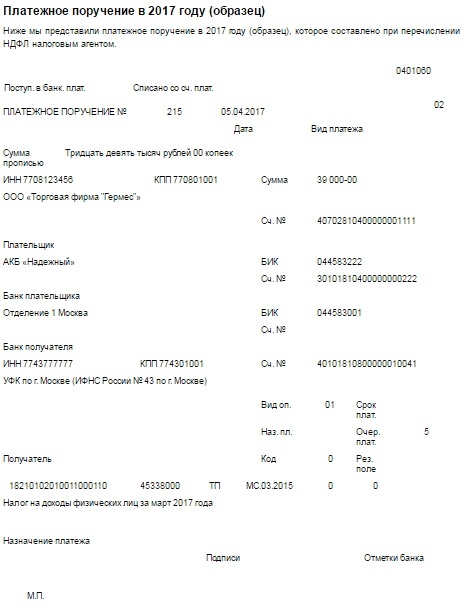

Very often in the tax system there are various kinds of changes, additions, adjustments, the Ministry of Finance makes amendments, etc. To keep track of them to all persons related in one way or another with tax documentation is quite difficult. Whether it is a private entrepreneur or a big enterprise. And in the case of incorrectly decorated / completed orders, unwanted problems may occur. In order to avoid this, you need to know how to fill the payment order.

The procedure for filling out a payment order in 2017

- Field No. 3 - We introduce the payment order number. It usually consists maximum of 6 digits. If the number of numbers more than three are closely watching that the latter numbers are not zeros (for example, after 999 goes 1001, and not 1000).

- Field No. 4 - indicate the date of the document in the format number, month, year (for example, 07/07/2016).

- Field No. 5 - is filled only in the case of sending a document through "Client-Bank" (electronically). Otherwise, we leave the field untouched.

- Field number 6 - we prescribe the amount.

- Field No. 7 - indicate the amount in digital equivalent, while separating the rubles from kopecks using a dash (for example, 15000-75). In the absence of kopecks, we put the sign of equality (for example, 15000 \u003d).

- Field No. 8 - indicate the payer - the full / abbreviated name of the enterprise, its address. At the beginning and at the end put the sign "//".

- Field number 9 - enter the payer's account number.

- Field No. 10 - indicate the full name of the bank, with which we work (the payer's bank). Be sure to indicate its location (city).

- Field No. 11 - we prescribe a bank identification code with which you work with (bik).

- Field number 12 - We prescribe the correspondent account number of the Bank, with which we work.

- Field number 13 - indicate the full name of the recipient's bank, including its location.

- Field number 14 - Here you need to specify the identification code of the recipient's bank.

- Field No. 15 - indicate the account of the recipient of money in the bank (only in case it is not the Central Bank of the Russian Federation).

- Field No. 16 (recipient) - the federal treasury organ is acting as such (we indicate abbreviated), be sure to mark the name of the tax service in brackets (for example, UFK MF RF in the Perm region (the Federal District of Russia in the Perm region of the Perm Territory).

- Field number 17 - indicate the recipient's account.

- Field No. 18 is the type of operation carried out (for payment orders - "01").

- Field No. 19, 20 (term and appointment of payment) - we skip.

- Field No. 21 - We write the order of payment (3 - forced recovery of debts; 5 - if you pay yourself).

- Field No. 22 (a unique charge identifier) \u200b\u200b- we put "0", except when it is registered in the requirement to pay the tax.

- Field No. 23 - is filled only in individual cases (see regulatory acts of the Central Bank of the Russian Federation).

- Field No. 24 - additional information that will help identify the payment (for example, the name of the document, which is the basis for payment, payment time, etc.)

- Field No. 43 - put your print. If there is no such, we specify "b / p".

- Field No. 44 - put a signature (we clarify that only a list of persons rendered in the bank card is only a list of persons rendered in the bank card).

- Field number 45 - we skip.

- Field No. 60 - enter a 12-digit Inn payer. Does not concern individuals if fields No. 22, 108 are filled.

- Field No. 61 - Enter the Inn tax.

- Field No. 101 - In this column, it is necessary to register its tax status (it depends on the income article). If we are talking about the tax from employees - write "02", if about income from business activities - "01".

- Field No. 102 - indicate the payer's PPC (the first 2 digits are not zeros).

- Field No. 103 - indicate the PPC tax.

- Field No. 104 - CBC or budget classification code (20 characters).

- Field No. 105 - We prescribe the OCTMO code of the municipality.

- Field No. 106 - You must specify the basis for the current payment (insurance fee - "0", taxes two-digit letter code.

- Field No. 107 (tax payments) - Be careful, filling this graph, 10-digit code is made: the first 2 signs are periodicity; The following 2 is the period number (number of months for monthly payments, the number of the quarter - for the quarterly, etc.).

- Field No. 108 - this graph is fill only in the case of forced taxation of taxes, in the rest, we indicate "0".

- Field No. 109 - indicate the date of signing a declaration on the paid tax.

- Field No. 110 - We skip.