Each individual entrepreneur must lead the "book accounting book of income and expenses." This book will definitely require a tax inspector when the time of the next check of your activity comes. The same book is required to conduct an enterprise working on a simplified tax system. The title page is the "face" of the book, so it must be filled out correctly.

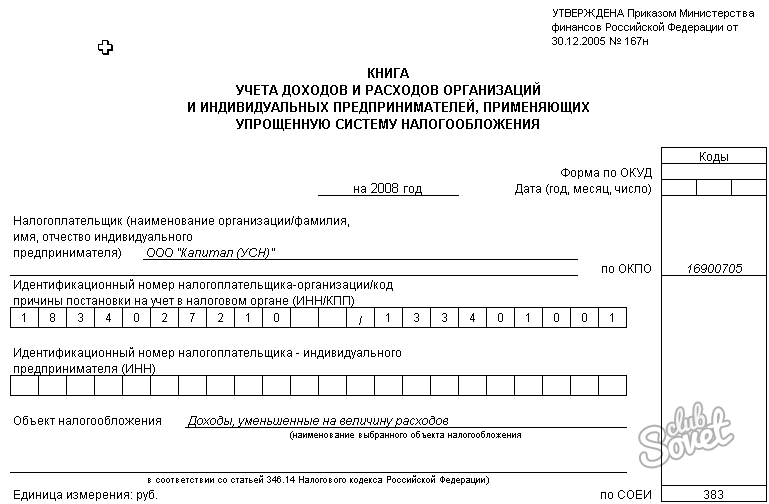

At the top of the title leaf, immediately called the book, there is a string in which it is necessary to make the year of maintaining income and expenses. Below the lines where the year is specified, there are two lines in which the name of the entrepreneur or the name of the enterprise is made. Under the name of the enterprise or the surname of the entrepreneur there are two lines in the form of cells in which the enterprise, or the INN entrepreneur, or the PPP should be made. Only those cells that are intended for a specific user of the book are filled. Next, the lines "Taxation Object" and "Unit of Measurement" are filled.

If you correctly fill in the title list of "books of income and expenses", then the tax inspector will understand that in front of him a very competent entrepreneur. By placing a peremid representative to themselves, it will be easier for you to work with it.