Capture is a set of measures for the passage of the goods across the border if it is purchased from a foreign seller. For this procedure, you will need to issue a number of documents and implement the necessary payments. Errors in documents can lead to fines and losses from downtime.

Collect a package of documents to provide at customs. Depending on whether you act as an individual or legal, which customs code is assigned to the imported goods, what kind of transport it is delivered, the list of documents will be different. Find out in the customs authority or on the official website Federal Customs ServiceWhat paper needs to be prepared, among them must be:- covenant (a document confirming the ownership of the shipped goods);

- invoice (list of goods, their number and price);

- certificate;

- specification;

- packing list with translation;

- sanitary and epidemiological conclusion.

- customs clearance;

- import duty;

- terminal fees;

- VAT;

- excise fees;

- freight;

- payment of temporary storage warehouse.

- GTD - cargo customs declaration. The TD1 form is filled for the product of one name. The added form of TD2 is filled in case of the name of the goods anymore.

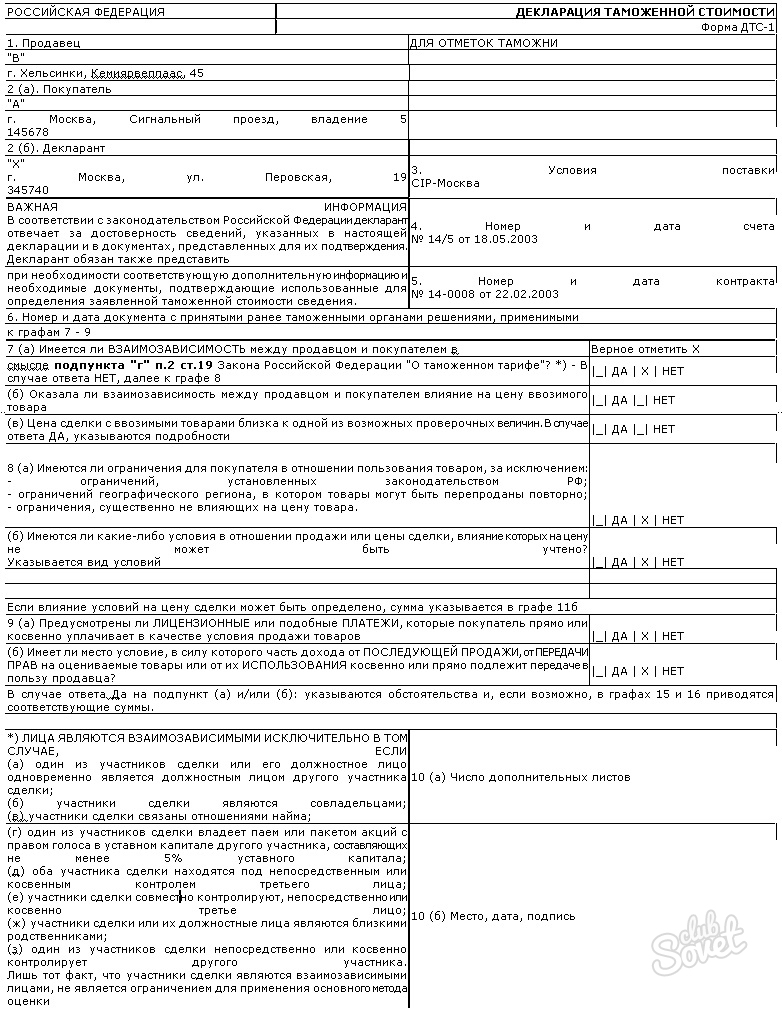

- DTS - Declaration of Customs Cost. Depending on the method of calculating the cost of the goods, the form of DTS1 or DTS2 is filled.

- KTS - Customs value adjustment. The main form of KTS1 is filled to adjust the value of one product, the addition sheets of KTS2 - to clarify information about multiple product names.

Swing on our website:

Cargo Custom Declaration TD-1

Cargo Custom Declaration TD-1 Sample fill in the cargo customs declaration TD-1

Sample fill in the cargo customs declaration TD-1 Cargo Customs Declaration TD-2

Cargo Customs Declaration TD-2 Declaration of Customs Cost DTS-1

Declaration of Customs Cost DTS-1 Customs value declaration sample DTS-1

Customs value declaration sample DTS-1 Declaration of Customs Cost DTS-2

Declaration of Customs Cost DTS-2 Sample Filling Declaration of Customs Cost DTS-2

Sample Filling Declaration of Customs Cost DTS-2 Customs value adjustment KTS-1

Customs value adjustment KTS-1 Customs value adjustment KTS-2

Customs value adjustment KTS-2

Choosing a foreign supplier, keep in mind that the least problems occur when it receives goods from countries such as Poland, Germany, USA. Customs clearance from Turkey is fraught with difficulties in determining the authenticity of product quality certificates. The design of goods from China is even more troublesome business - too low the cost of cargo, declared in the documents, determines the strengthened control by the customs service.