Purchase and sale of a share in a limited liability company (hereinafter referred to as LLC) is a fairly common transaction. As a rule, this happens when one of the community participants leaves the business, thereby transmitting their property rights to another founder. The reasons for the sale may be several. But in any case, do not do without correctly drawn up documentation - contract, acceptance, form p14001, etc. Let's consider in more detail how it happens.

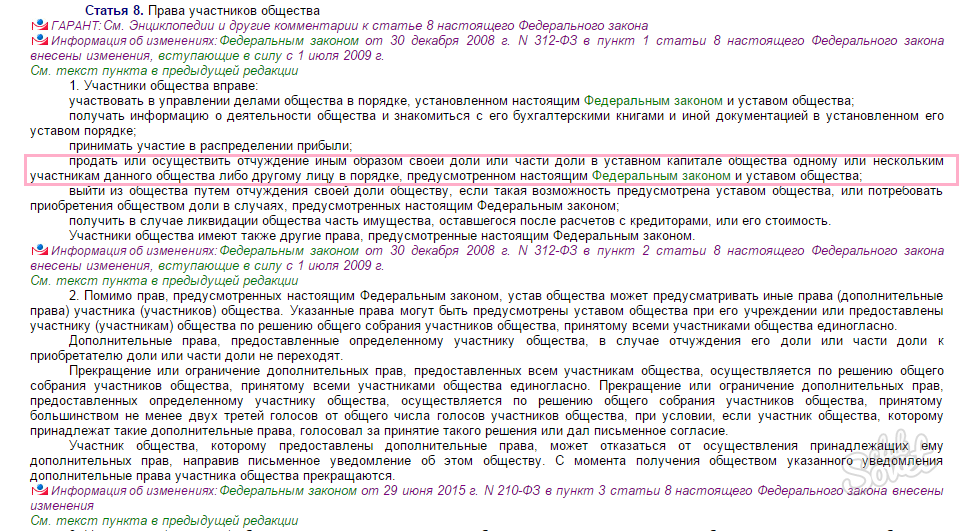

Legislative nuances

As a rule, all possible operations related to the purchase and sale of the share of society, as well as the procedure for the action of participants in this case are spelled out in the company's charter. However, there are also non-standard situations when without the help of an experienced lawyer just can not do. The main thing is that the transaction does not contradict the "canons" of the current legislation. We are talking about the main positions. Law of the Russian Federation "On Limited Liability Societies", and Civil Code of the Russian Federation.

Buying a third party

In this case, the transaction is mandatory to be notarized. Actions are performed in such a sequence:

- In general fees, the founder declares its intentions. By this time, he should have a pre-prepared written notice of sale. Such a document in legal practice is customary to call the offer. When it is drawn up, it is important not to miss:

- personal information about the seller (name, passport details, address);

- the size of the share of capital in LLC;

- transaction price;

- terms of sale.

- At the "meditation" on the offer is given to 30 days. At the same time challenge or offer another price is strictly prohibited. If the buyer accepts the terms of the transaction - he prescribes his consent in the statement. Otherwise, information about the refusal must be fixed in a special notice.

- A positive result is fixed by the conclusion of the contract of sale.

- After the transfer of property rights, changes should be made to the constituent composition of the enterprise. To do this, prepare a document in form P14001. By the way, the detailed instructions for its design is given in our article - "How to fill out the form p14401".

Buying a member of the organization

Such a procedure, as a rule, passes much easier and faster. In addition, it does not require notarization. Schematically it looks like this:

- The seller declares her desire at a general meeting.

- This issue is discussed on the agenda.

- If the charter of LLC does not record the mandatory consent of all founders, the transaction passes without special nuances. Otherwise, it is necessary to vote and seek universal "recognition."

- The fact of buying and selling is entered into the minutes of the meeting, as well as in a special notice-offer.

You can download on our website:

Approximate Sample Treaty of Purchase of Share in Ltd.;

Approximate Sample Treaty of Purchase of Share in Ltd.; Exemplary sample filling in the contract of sale of shares in the authorized capital of LLC;

Exemplary sample filling in the contract of sale of shares in the authorized capital of LLC; Approximate Sample Offer when selling a share in LLC;

Approximate Sample Offer when selling a share in LLC; Exemplary filling of the offer in the case of the sale of the share of LLC;

Exemplary filling of the offer in the case of the sale of the share of LLC; Exemplary sample acceptance;

Exemplary sample acceptance; Approximate Sample of the Protocol Meeting Founders Ltd.;

Approximate Sample of the Protocol Meeting Founders Ltd.; Exemplary sample filling out the decision of the founder of LLC to sell his share.

Exemplary sample filling out the decision of the founder of LLC to sell his share.

Buying another legal entity

Such a procedure is simple, if it was initially resolved by the issue with the rest of the founders of LLC. You do not need to refer to the notary in this case. The scheme of action is as follows:

- The seller sends a notice with its "colleagues" with a description of the sale situation.

- Buyer, taking all the seller's terms, draws up acceptance and makes payment on the accounts of the enterprise. In this case, the received amount is equal to the contribution to the authorized capital.

- The legal entity has the right to redeem its share during the year or distribute it between the other participants.

Download right now:

Sample notification for the sale of a share;

Sample notification for the sale of a share; Filled sample notification for the sale of share;

Filled sample notification for the sale of share; Approximate sample application form P14001;

Approximate sample application form P14001; Exemplary Document Form P14001.

Exemplary Document Form P14001.

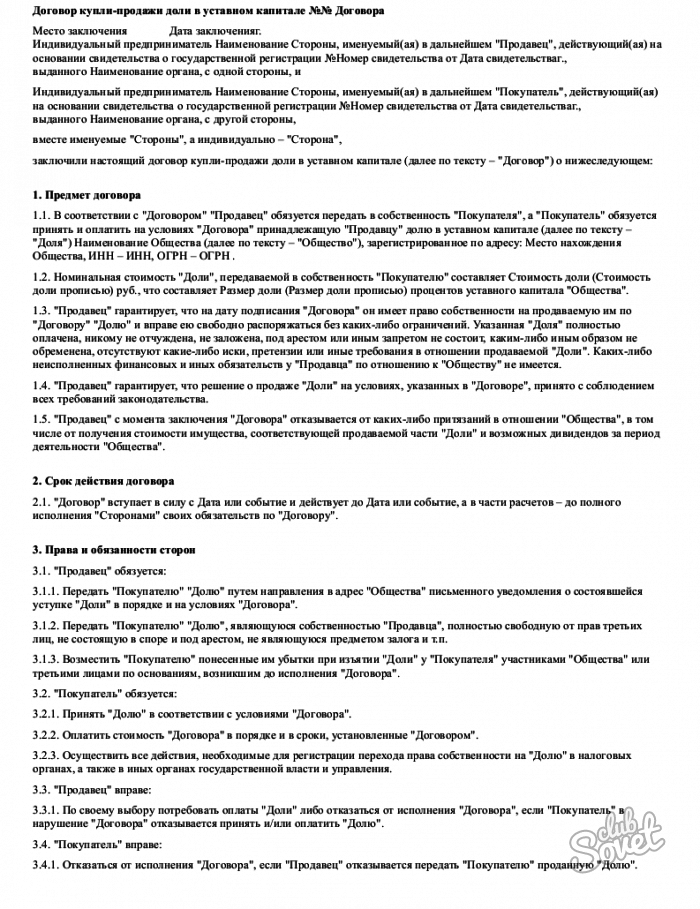

Contract of sale

This document is the main one in the transfer of property rights of one of the fractions in LLC. In any of the above options, the situation is completed by the conclusion of the contract in three copies. As a rule, it has a standard template, and its sample is easy to find in Internet resources. When making a document, use the following recommendations:

- In the "header", specify the place and date of conclusion of the contract. Just below, write information about the sides of the transaction - FULL NAME, passport details, address. If the buyer performs a legal entity, it is necessary to write its full name, the OGRN code, TIN, etc.

- The next block is the "subject of the contract". Here, describe the essence of the transaction: What is for sale, what is the price, the conditions of operation, etc.

- Separate item, issue a validity of the document. We write when the contract comes into force (a specific number or an offensive of a certain event).

- The next section is the "payment order". Here, specify the cost of the share, the terms of payment (cash or cashless), as well as the possibility of prepayment.

- Next, describe the responsibility of the parties in violation of the contract, force majeure circumstances and the conditions of termination of the document. Of course, such questions are previously discussed between the parties to the transaction.

- At the end of the contract, do not forget to write full details of the buyer and the seller (name, address, telephone, bank account, tax code, etc.).

- Create a document with signatures of both sides.

With any change in the constituent company, LLC it is necessary to notify the tax authority at the place of registration. To do this, grant the filled form P14401 into the inspection.