Registration of the insurance policy of civil liability (OSAGO) is possible both in paper and electronic form. The last option is gaining increasing popularity due to its availability and ease of registration - the car owner can get the necessary insurance without leaving at home. How to do it?

Stages of the insurance policy in electronic form

It is worth noting that only those car owners, the data of which are present in the system of motorways (RSA), can take advantage of the remote design of the document.

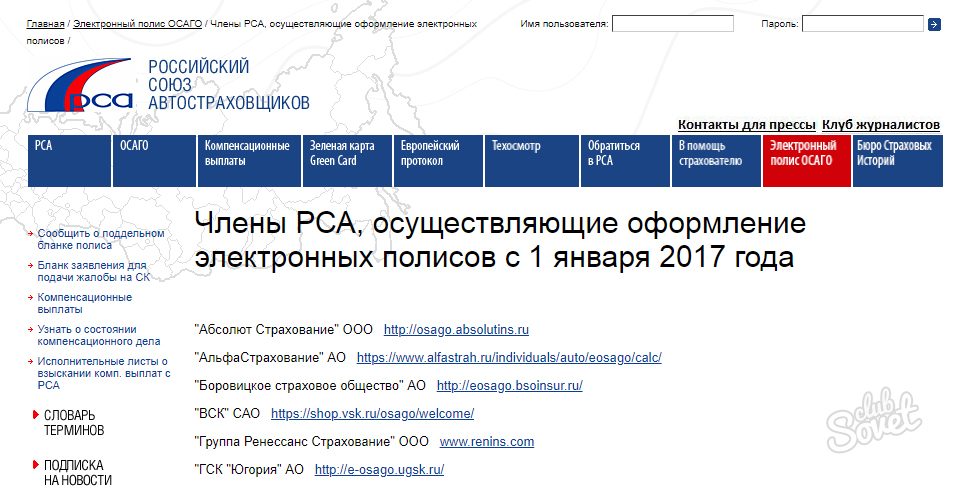

Policy electronically issued the same insurance companies that are engaged in the provision of CTP in paper. If the company has the right to issue insurance on paper, it is obliged to provide this type of document and electronically. The current list of registered insurance organizations that are licensed to issue an OSAGO policy - Registry.

Before the start of the insurance policy, make sure that the following documents are available:

- Passport of the car owner.

- Registration certificate for transport.

- Certificate of driving (all persons who will be allowed to control the car).

- Actual diagnostic card. This document suggests that the car has passed a technical inspection, regularly and can ride.

The procedure for placing insurance includes the following steps:

- Go to the site of the selected insurance organization.

- Pass the registration on this portal using the mobile number, as well as the email address.

Passing the registration procedure, the owner of the car receives access to his personal account (it will store information about it, as well as about all drivers who are given permission to manage this vehicle). Also in the office will be stored and decorated (valid) insurance policy. If you wish, you can print and carry it. - In the Personal Account fill out an application for execution of the policy. In the presented form, you must enter information about the car (category, brand, color, year of release), as well as drivers data that will be able to control the car (if insurance is issued with limitations). Regardless of what form of the policy you chose, there is the possibility of making insurance as limiting (the exact list of possible drivers of this means in the amount of no more than 5 people), and without that. All information that will be entered will be checked, so indicate only reliable information.

- After checking the data and fill all the sections of the application, you will see the final cost of your policy. Some companies persistently offer additional (of course paid) options. Be careful when filling out the application and do not choose what you do not need. When the result suits you, click "make a policy."

- You will be transferred to the payment page. In most cases, payment is made from a bank card, although some companies can also receive electronic cash. Carefully learn the page, it must be protected (this is evidenced by the lock in the address bar of the browser). It is strictly recommended to enter payment data on unprotected sites.

After successful payment on the email specified during registration, the insurance policy in the PDF format will be sent.

Disadvantages of the electronic insurance policy compared to paper analog

Among the negative points of the design of the electronic policy, the following can be distinguished:

- Electronic policy can not be made on a new car.

- There is no possibility of making Europrotokol.

- When checking an electronic document, traffic police officers may arise some technical difficulties.

- Increases the likelihood of overdue insurance due to technical malfunctions.

- There is a risk to arrange a document on a dubbed scam site.