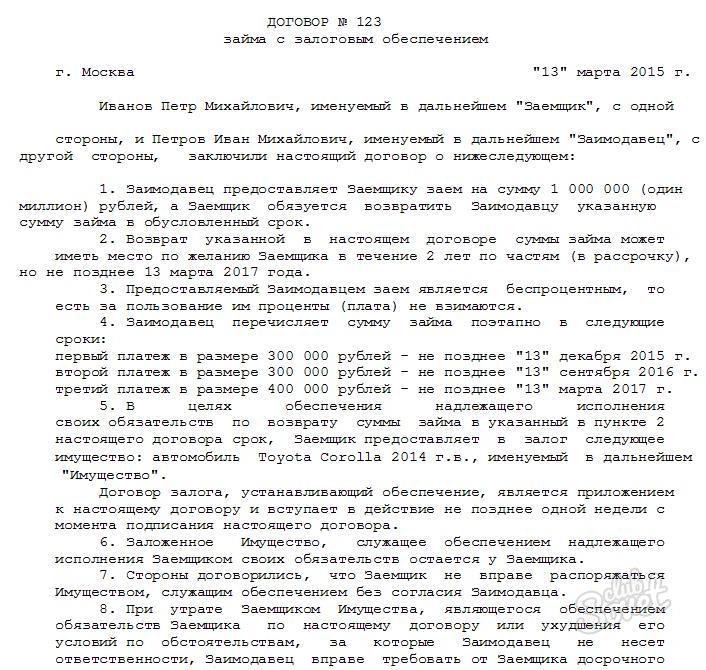

A loan agreement with a deposit is a document for which one side (borrower) receives funds for temporary use from the second side (mortgagee) secured by the agreed property. In the event of a delay (non-payment of obligations according to the available schedule of funds return), the pledgee receives the right to implement the provision of provision.

The loan agreement is pledged in writing and is subject to a notarial certificate. This may be one document, which describes the conditions for providing a loan and registration of encumbrance, and may be two separate documents with references to each other. In the second case, the conditions for the provision of a loan are recorded in the main contract, and in the second, the order of securing obligations. As a collateral, any liquid property belonging to the mortgagor in the rights of ownership or economic ownership may be:- real estate;

- vehicle, special equipment;

- equipment;

- goods in circulation;

- personal belongings;

- property rights (except for those for which the concession to another person is prohibited by law - alimony, insurance, etc.).

- loan amount;

- return period (with a schedule);

- support;

- assessment of the subject of the pledge;

- the location of the provision (usually the subject of the pledge remains at the pledger, but other conditions may be provided in the contract at the discretion of the borrower and creditor).

- the emergence of the right of collateral;

- subsequent deposit;

- the rights of the mortgager to restore the pledge after its loss;

- the risk of random damage to the subject;

- the procedure for implementing the provision;

- responsibility of transaction participants;

- the procedure for termination of the contract and others.

Loan agreement with mortgage;

Loan agreement with mortgage; Sample loan agreement with mortgage;

Sample loan agreement with mortgage; A contract of loan with a deposit of real estate;

A contract of loan with a deposit of real estate; Sample loan agreement with property pledge.

Sample loan agreement with property pledge.

A competent loan agreement with a deposit will help take into account the interests of each side. It guarantees the fulfillment of obligations under the agreed period, regulates the procedure for resolving controversial situations. When concluding a loan agreement with ensuring, it is worth contacting the competent specialists who will help to make a document legally correct.