The yield of any contribution depends on several factors: the amount of the rate, the time of placement of the contribution, as well as the procedure for accrualing interest.

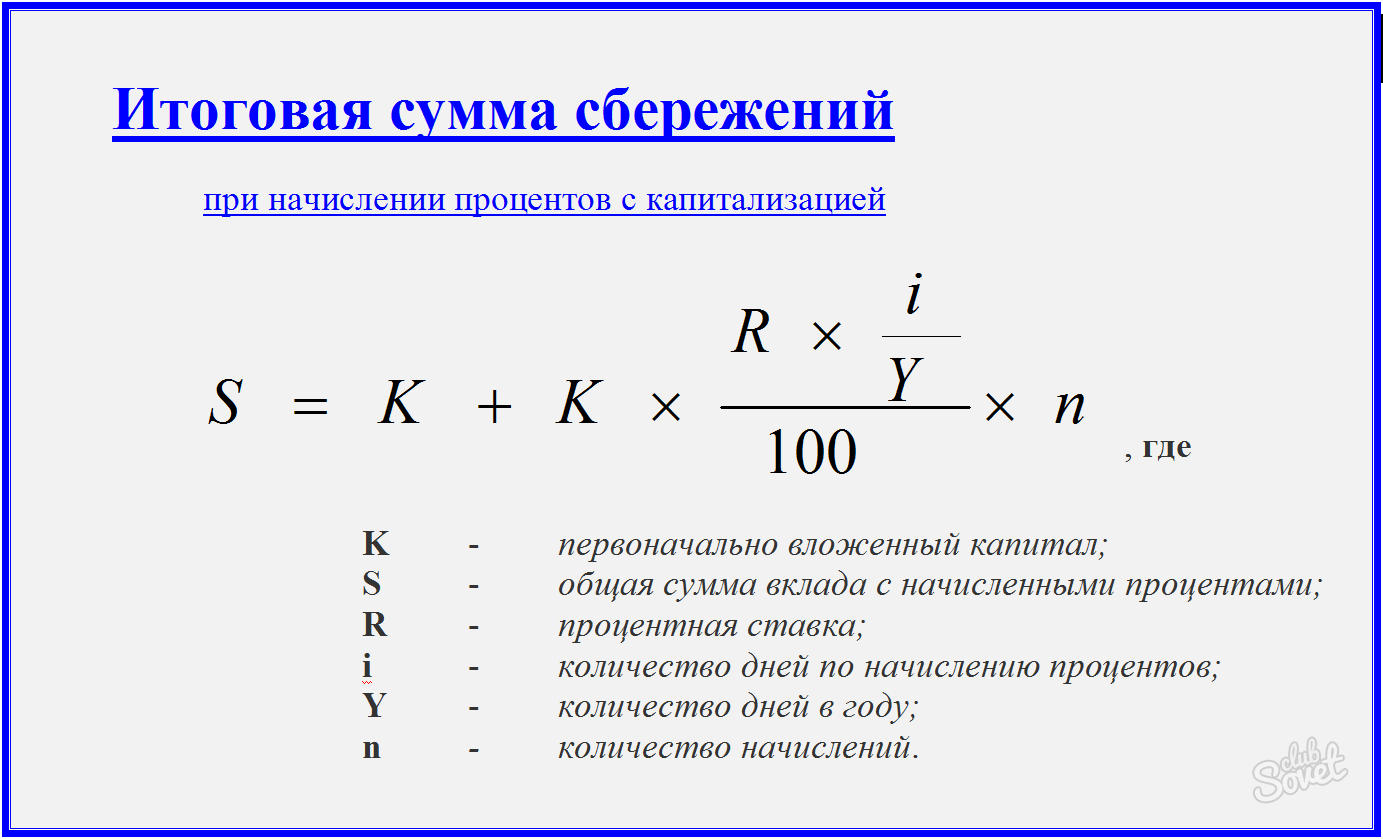

Sometimes the contribution with a lower rate can give greater income than the contribution whose rate is higher. This is due to the procedure for accrualing interest on the contribution. Accrual of interest may occur at the same time at the end of the term of the contract or with some frequency, for example, every month or quarter. In addition, each of the options can be with or without capitalization. The capitalization of interest means the addition of accrued interest to the initial amount of the contribution, as a result of which the percentage of interest will be accrued not only on the amount of the deposit, but also to the percentages of previous periods. In this case, we are talking about a difficult percentage. The final amount of the deposit at a time accrual of interest at the end of the term of the contract without capitalization of interest is a set of embedded amount and actual yield. To calculate the profitability of the deposit deposit:- find the share of days for which interest is accrued (if the month is 28/29/30/31 day, if the quarter is 90/91/92) to the number of days a year;

- multiply the value obtained to the amount of the deposit and interest rate;

- divide the work on 100 and add the amount made.

- deposit amount - 100,000 rubles;

- deposit term - 1 year;

- interest percent each quarter;

- the rate is 12% per annum;

- divide the number of days in a quarter by the number of days a year: 91/365 \u003d 0.25;

- multiply this value to the attached amount and interest rate, divide by 100%: 100000 × 14 × 0.25 / 100 \u003d 3500;

- multiply the number of accruals and add the initial amount: 3500 × 4 \u003d 114000 rub.

- the amount of replenishment is 3, the total amount of replenishment - 150000 rubles;

- for the first quarter, percentages will be 8975.34 rubles: 300000 × 0.12 × 91/365;

- for the second, taking into account the replenishment - 10471.23 rubles: (300000 + 50,000) × 0.12 × 91/365;

- for the third - 11967,12 rubles: (350000 + 50,000) × 0.12 × 91/365;

- for the fourth - 13463,01 руб.: (400000 + 50,000) × 0.12 × 91/365;

- total interest accrued - 44876.7 rubles;

- the final amount to the issuance of the contract for the end of the contract is equal to 494876.7 rubles.

In each banking contribution agreement, the conditions for early termination of the contract are described. Most often it is planned to return interest on the deposit in favor of the Bank.