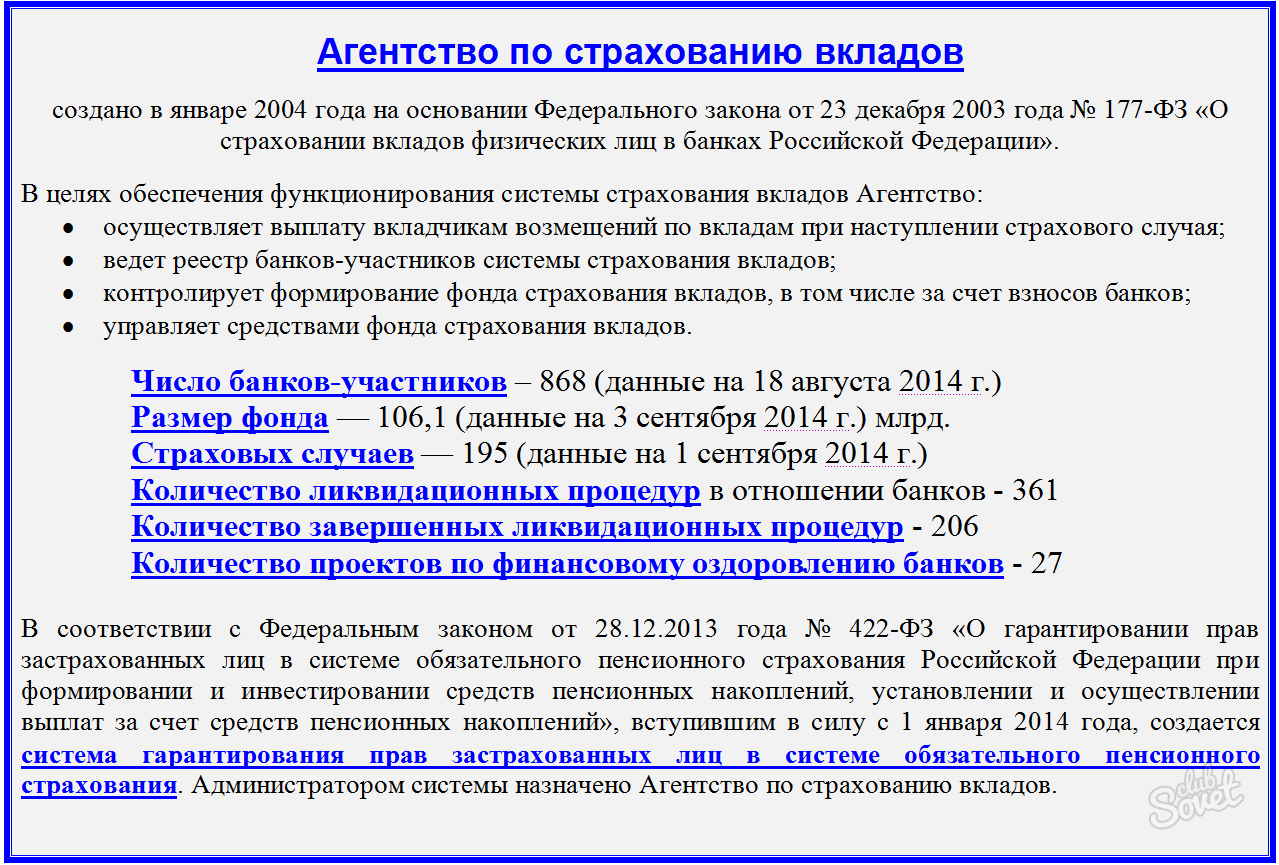

Deposits are subject to insurance in case of bankruptcy or imprisonment of the license of a banking institution, provided that this bank is a member of the deposit insurance system. To avoid fraud and not losing the cash invested money, come with seriousness to the choice of the bank and take into account all the nuances of insurance conditions.

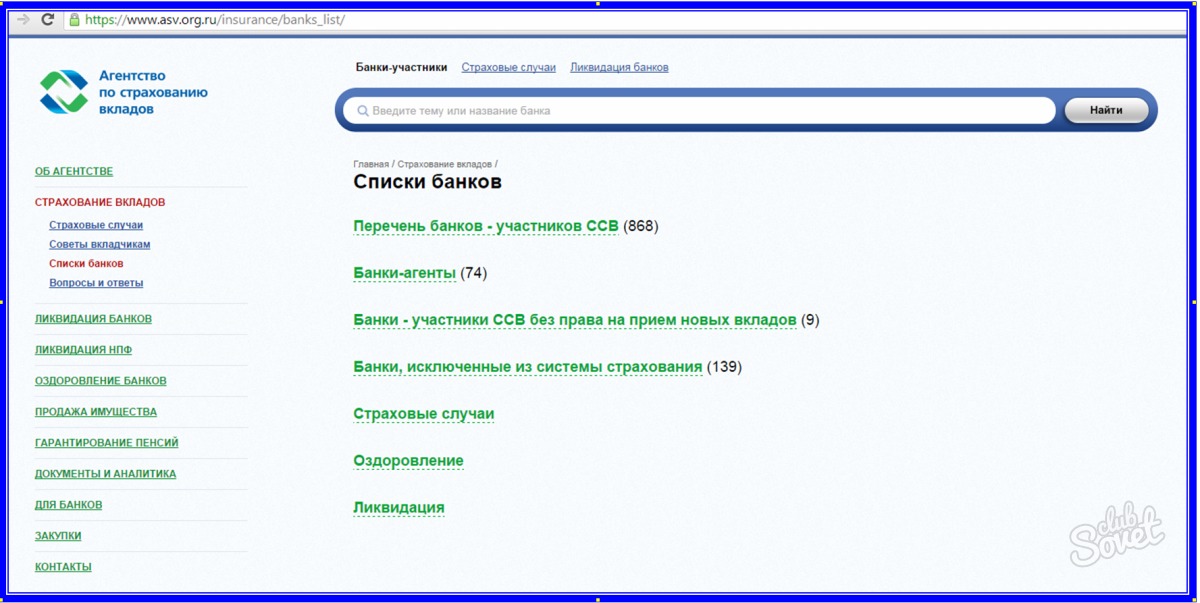

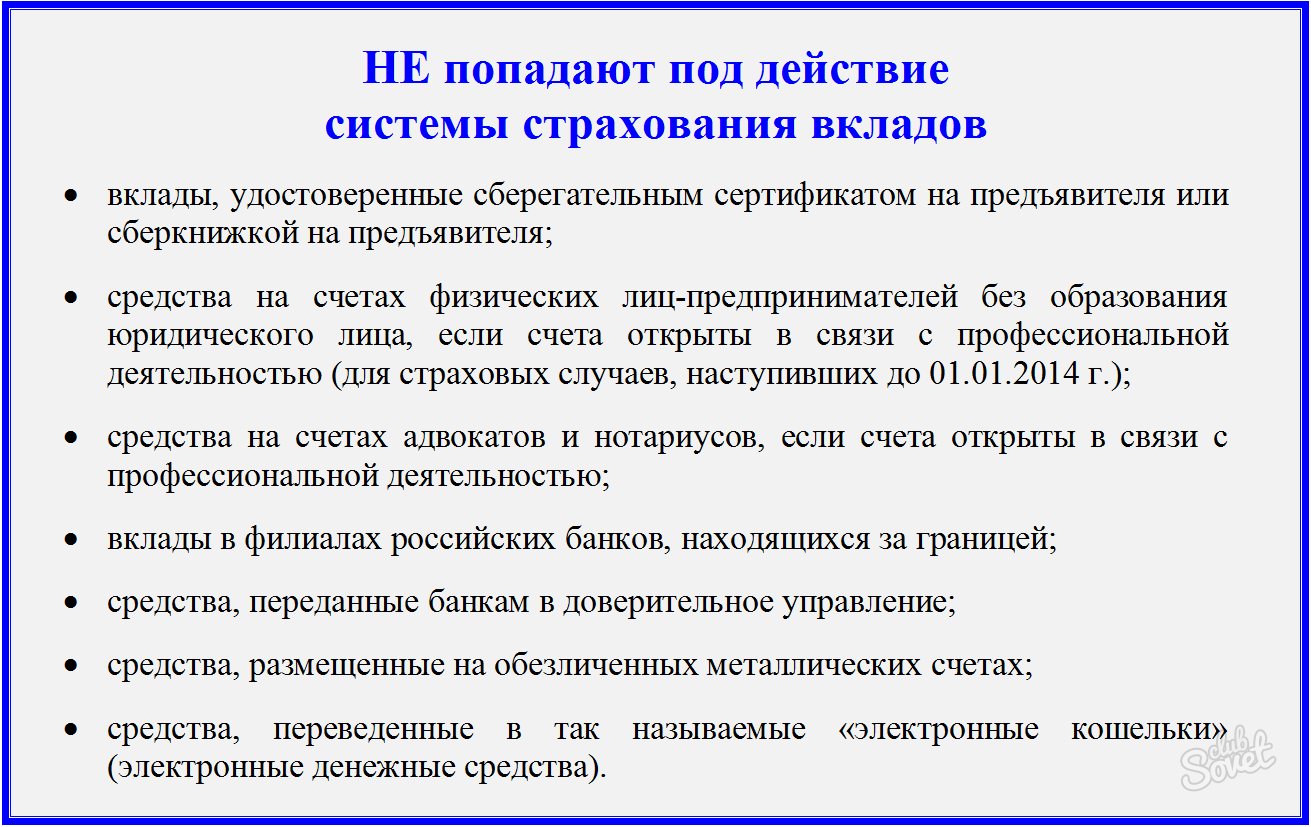

Choosing a bank to accommodate the deposit in it, follow not only the terms of lending, for example, the interest rate, the procedure for accrual interest, the presence of capitalization. Ask employees if the bank is a member of the Deposit Insurance System. Or review the information on site Deposit Insurance Agency: List of banks that are participants or agents in CER, banks that are not entitled to take new contributions, or banks that were excluded from the CER.- deposits in the branches of Russian banks abroad;

- deposits in an impersonal form (precious metals);

- electronic money;

- savings certificates issued for bearer.

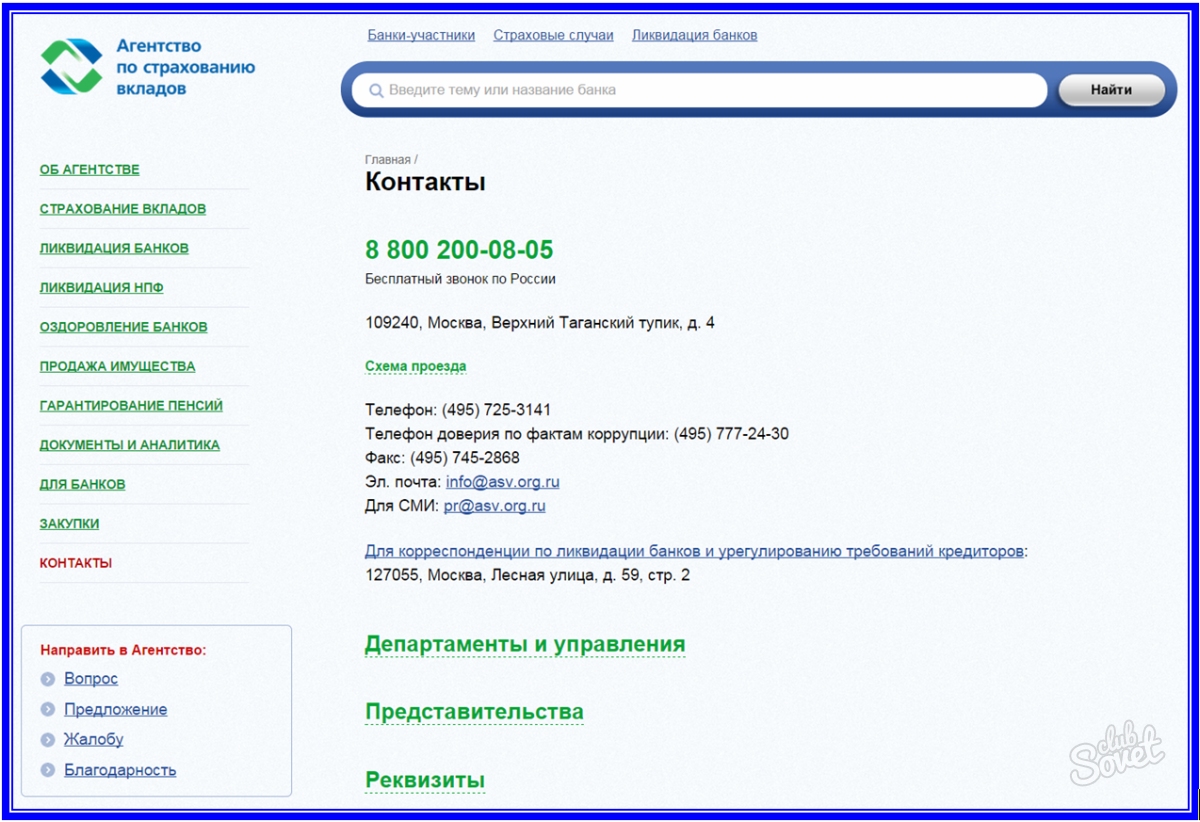

By phone of the hotline of the Insurance Agency of Deposit 8-800-200-08-05, you can get additional advice on the function of the deposit insurance system. All calls within the Russian Federation are free.