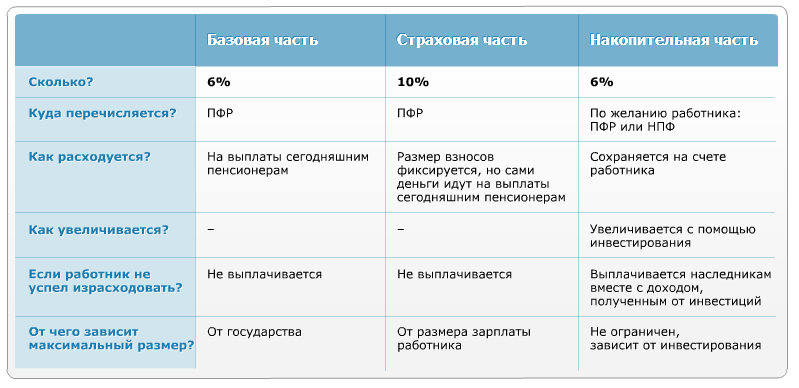

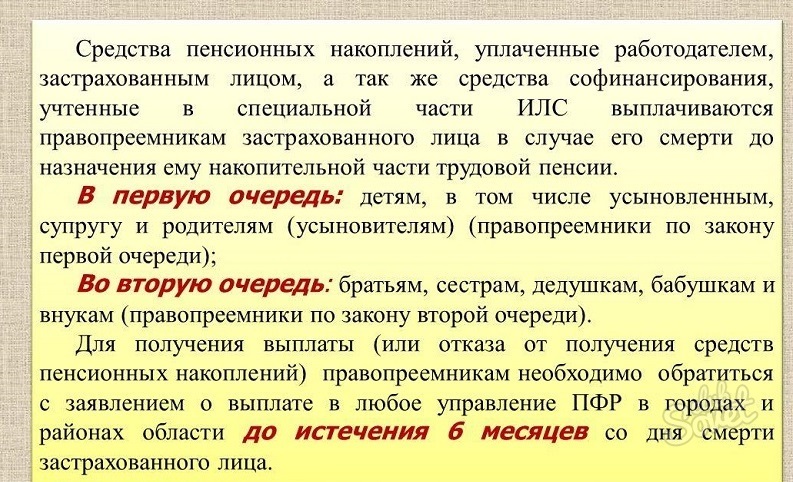

The management of organizations carry out deductions to the pension fund in the amount of 22% with wages of workers. Of these, 16% - for the insurance part of the employee's pension, and the remaining 6% are for cumulative. V legislation It is said that citizens have the right to receive accumulations in the form of: a one-time payment, a monthly urgent payment, a cumulative pension, a one-time payment received by the successors of the deceased person.

If you apply for a one-time payment, remember that it can receive: persons having a disabled group (1.2 or 3rd); those who have lost the breadwinner; Persons receiving pension for state support. The only condition - in all these citizens to the retirement age should be lacking the necessary insurance experience or the magnitude of the pension indicator in order to appoint them an insurance pension. And can also get such payment and those who have a small accumulative part of the pension (less than 5% of the value of the insurance part). For payment you need to write a statement in PF RF At the place of residence, or in your NPF and some other documents (passport, SNILS, certificate of experience, details for the transfer of funds). The application will be reviewed within 1 month.Application form and filling recommendations are presented on our website:

Application form for a lump sum payment;

Application form for a lump sum payment; Recommendations for filling out an application for providing a lump sum payment.

Recommendations for filling out an application for providing a lump sum payment.

Application can be sent by mail. On our site there is a sample and a form of this application:

Application form for urgent payments to NPF;

Application form for urgent payments to NPF; Sample Filling out an application for the provision of urgent payments to the NPF.

Sample Filling out an application for the provision of urgent payments to the NPF.

![]() Application form for the accumulative part of the labor pension in NPF we have.

Application form for the accumulative part of the labor pension in NPF we have.

![]() Sample application for the accumulative part of the labor pension in the NPF here.

Sample application for the accumulative part of the labor pension in the NPF here.

![]() Application form to receive savings by successor we have.

Application form to receive savings by successor we have.

![]() Sample application for payment by legal succession Look here.

Sample application for payment by legal succession Look here.

The main thing in the procedure for issuing cumulative payments is to collect the necessary documents. It happens that for ordinary citizens, it becomes quite laborious. We hope that thanks to this article, you have got the necessary knowledge and now easily prepare all the documentation for contacting the Pension Fund.