Complete times have come, and you realized that the business became unprofitable? In this case, it is worth closing your enterprise. This process is long. But if you carefully understand and explore the legal nuances, it will be not difficult. You will need patience, perfection and perseverance ...

So, you have a limited liability company (LLC), and you have adopted an independent decision on its liquidation. Before the start of this procedure, it is necessary to prepare, namely, to process reporting, eliminate all errors and shortcomings, pay off all debt to creditors and tax inspections.

- Charter LLC;

- Receipt of payment of duty;

- Application request to liquidate LLC;

- Certificate-notification of the closure of LLC;

- Liquidation balance of the enterprise.

With all documents, go to the Inspectorate for writing an application for the liquidation of the enterprise. If the documentation is collected correctly, an employee of the above inspection makes records to the state register of enterprises. From this point on, the closing process of your LLC begins.

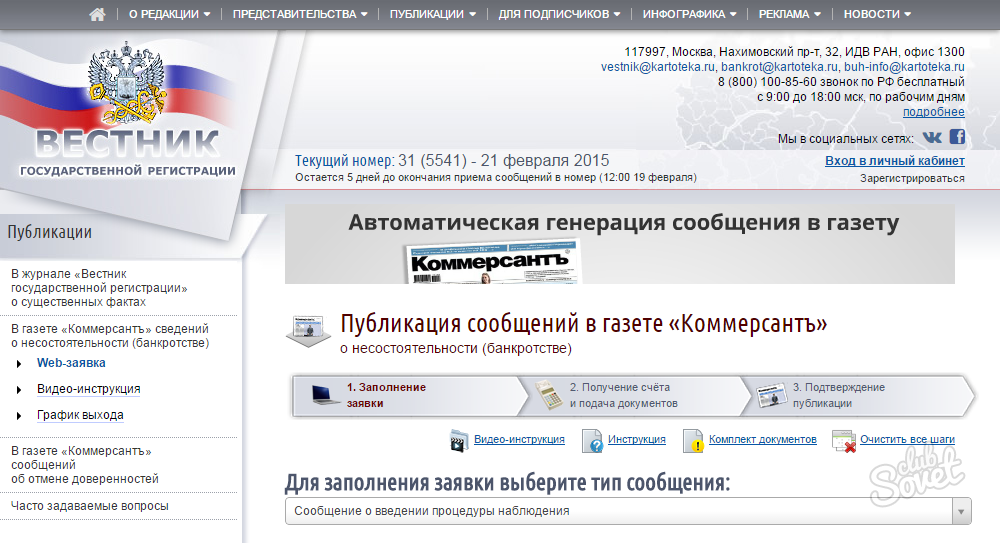

Download right here on the portal:

- Application for publishing (2 copies);

- A document confirming the payment of state duty;

- Accompanying letter (2 copies);

- Act decision on the beginning of elimination.

The company is obliged in writing to warn all its creditors about the start of the closure process so that they receive their money before liquidation. The deadline for claims from creditors is 3 months.

Download from us on the portal:

Sample application for publishing a message about liquidation;

Sample application for publishing a message about liquidation; Filled sample application for publishing a message about liquidation;

Filled sample application for publishing a message about liquidation; Sample notification of creditors on the liquidation of LLC;

Sample notification of creditors on the liquidation of LLC; Filled sample notification of creditors about the liquidation of LLC.

Filled sample notification of creditors about the liquidation of LLC.

- Approval of the liquidation balance (form 15003);

- Decision on the statement of PLS;

- Confirmation of publication in the "Herald";

- Liquidation balance of the enterprise.

After approval of the PLB, the company fully considers all the requirements of creditors, satisfying them. The process of creating a liquidation balance (LB) begins. He is approved by the minutes of the meeting of all the founders of societies and is issued a decision on the creation of LB.

Download from us on the portal:

Sample protocol on the approval of the intermediate liquidation balance;

Sample protocol on the approval of the intermediate liquidation balance; A completed sample protocol on the approval of the intermediate liquidation balance;

A completed sample protocol on the approval of the intermediate liquidation balance; Sample decision on the approval of the liquidation balance;

Sample decision on the approval of the liquidation balance; Filled sample decision on the approval of the liquidation balance.

Filled sample decision on the approval of the liquidation balance.

Closing LLC is a laborious process. Many companies use the services of private individuals for the closing of the business. But if you explore the entire legislative framework and follow the prompt instructions, you can do it yourself without any extra spending.

If self-closing company, it may come out even longer than its opening.

That's for sure. Well, outsourcing companies as to the registration and liquidation can help.