To close the credit card, it is necessary to pay off debt and interest and contact the Bank's Office for registration of the application. Details and nuances of the Credit Card Closing Procedure are read in this material.

Debt closure:- Even ate you did not use the credit card, at the time of closing the bill could form debt for annual service, SMS notice or account insurance. As a rule, signing an agreement with the bank and opening the map "Just in case", many do not pay attention to such things. If you have a number of years for several years, then interest and penalties for non-payment can be accrued to the amount of debt.

- To obtain information about the account status, use Internet banking, call a bank specialist on the hotline phone (in this case, you will need to call a code word) or contact the nearest branch of the bank.

- Pay off debt. This can be done with the ATM, payment electronic systems or other ways in the way.

- Please note that already after paying off the debt on the balance sheet, a negative amount may be formed. It depends on the method of interest accrual. Do not forget to clarify this moment.

- To make sure the calculation is correct, use credit Card Calculator.

- Do not forget to take a passport with you and credit card.

- You will need to fill out a statement in the form of the bank. Be careful when specifying the card number and passport data.

- Experts recommend to raise a copy of the statement. So you will have evidence in the case of his loss of bank employees.

- If a debit card with an open overdraft, then it may have a positive cash balance. In this case, it can be translated into any current account both in this and in another bank.

- The closed credit card must be cut in your presence. Subsequently, it is transmitted to destruction.

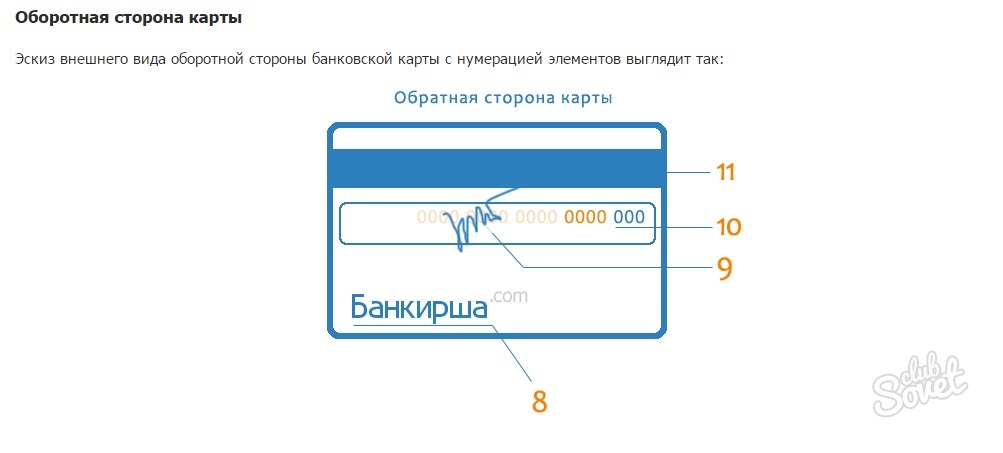

- In this case, you should immediately block the card. To do this, contact the bank employee by telephone hotline. It can be found in a loan agreement or on the website of the bank. Usually, this number is indicated on the back of the card, when you receive a credit card, it is immediately worth rewritten to the address book of the mobile phone.

- If your card managed to take advantage of the attackers, you will need to appeal to the police. The bank needs to provide a copy of the statement of law enforcement agencies. The issue of compensation for the amount of credit card debt in this case is considered by the Bank's Security Service. The decision is made individually.

- If you are planning to further enjoy your credit card of this bank, you will need to write an application for reissue.

The main regulatory documents regulating the closing procedure of credit cards is part 1 of Article 859 of the Civil Code of the Russian Federation and Instruction of the Central Bank of the Russian Federation of 05/30/2014 №154-and.