The best way to get rid of annoying collectors is to hire a loan lawyer. He knows all the nuances of this process and will be able to place everything into its place. And although independently, without the involvement of a specialist, it is quite difficult to achieve a positive solution to the issue, many are trying to counter collectors on their own. How to do it?

If you cannot pay a full loan fee, contact a bank asking for restructuring, providing a grace period. If there is an adequate reason (the financial situation has deteriorated, there was expensive treatment, a child was born, fired from work) the bank could meet and resolve the issue in peaceful way. Before visiting the institution, prepare: Check how much you can pay monthly. Collectors can work under a cessia agreement either by agency agreement. In the first case, the right to debt is rendered by the Bank by a collector firm, which acts at its own discretion, independently choosing the impact methods on non-payers and their guarantors. If there is an agency agreement, the right to require the Bank remains, and collectors perform intermediaries - remind of debt, force the situation. Therefore, the very first task for the period is to find out who owns debt.

- the visit of collectors home (an application for an attempt to illegally penetrate your housing, for hooliganism);

- night calls by phone (application for administrative violation);

- the requirement to pay debts without the provision of documents confirming such rights (statement on extortion).

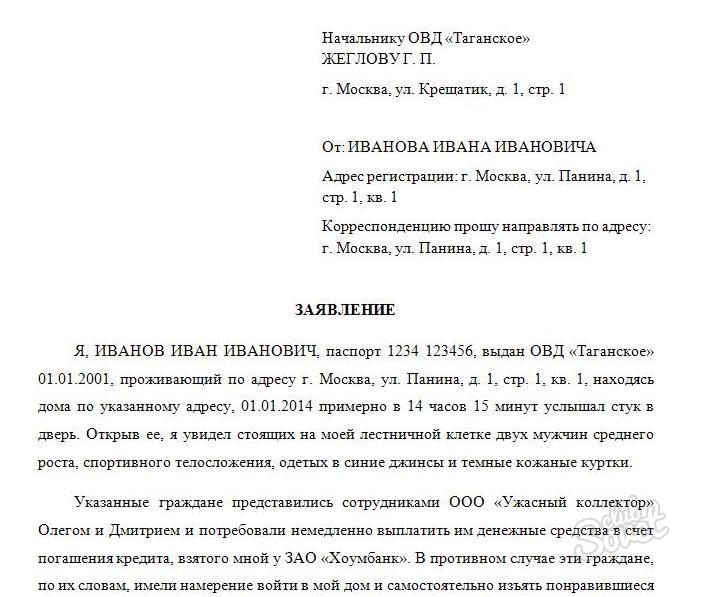

Application for collectors when trying to illegal penetration;

Application for collectors when trying to illegal penetration; Sample application for collectors when trying to illegal penetration;

Sample application for collectors when trying to illegal penetration; Statement of extortion;

Statement of extortion; Sample extortion statement.

Sample extortion statement.

If collectors behave aggressively, incorrectly, try to fall on video, photos, audio products. This will make proof of the violation of law enforcement on their part. Or find the witnesses of your meeting, such as neighbors.