If you decide to do the question of inheritance, it is worth it to approach - weigh all the "for" and "against", and only then to decide. In addition, today there is a huge number of experienced lawyers who will gladly take your business. At the same time you only need to decide what kind of gift to you like - through a doner or will. Let's consider more about their characteristic features.

Legislative aspects

To date, there are two alternative options for the transfer of property by inheritance:

- by issuing a donation agreement (domestic);

- through a notarial testament.

At the same time, it is not necessary to execute documents on a close relative, the property can be inherited to a friend, a simple friend, etc.

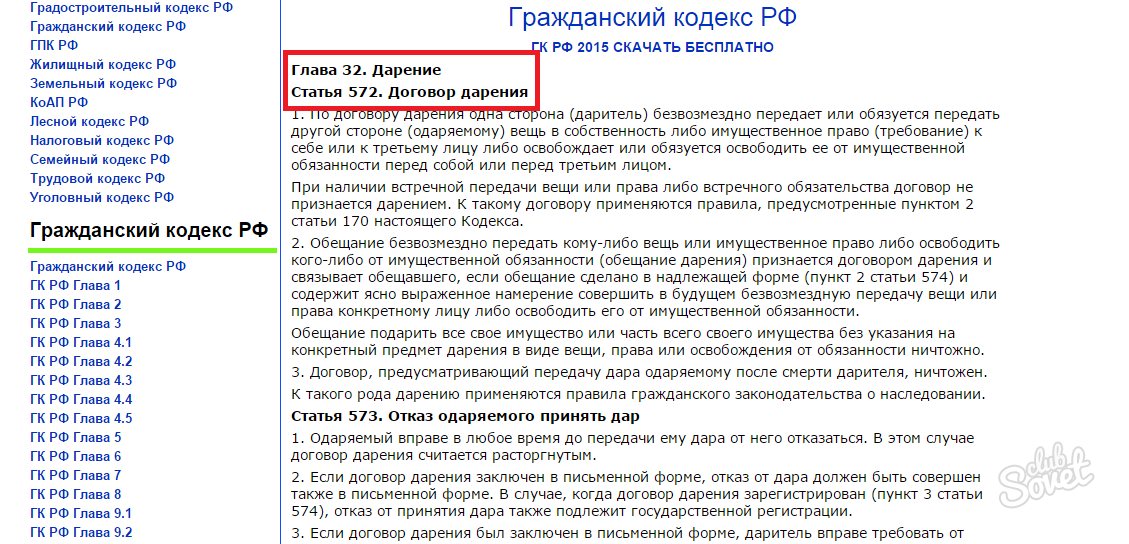

The basic principles and conditions of donation are prescribed in 32 chapter of the Civil Code (GC) of the Russian Federation. According to the law, one side transmits the other for continuous use of a specific property. Moreover, the donation is free of charge, and when the corresponding contract has already been signed, you are not entitled to demand the inheritance back or ask for money for its operation. If one of the parties wishes to abandon such a "gift", the moment you need to specify immediately - before the documentary procedure.

But the order of transfer of values \u200b\u200bthrough the testament is highlighted at the head 62 of the Civil Code of the Russian Federation. This document gives the right to dispose of a specific object of the inheritance after the death of the owner of values. Up to this point, an intrigue is created, which is called "secret will" in legal practice.

What to choose better

When choosing one or another way of transmitting values \u200b\u200bby inheritance, such essential factors should be taken into account:

- Urgency. The contract of donation allows us to dispose of property from the moment of signing the document, but the testament comes into force only after the expiration of the 6-month term after the death of the owner of values.

- Washed to deal. Make a gift in the form of an apartment or car - the pleasure is not cheap. To do this, you need to pay a fee in the amount of 1000 rubles. Moreover, the same amount is held with the new property owner - for state registration and documentary design of the facility. But when drawing up a will, you will spend only 100 rubles for the tax. However, "surprise" is expecting here for the heir - he will have to pay a duty to obtain a certificate of ownership of property in the amount of 0.3% of the price of an apartment, but not more than 100 thousand rubles.

- Order order. The donation agreement signs both parties in the presence of passport documents and real estate papers, and the testament is only the owner of the property. In the second case, noarial support is required.

- Possible consequences. By signing the gift, you are actually no longer owner owner, so there will be no opportunity to change your mind or something in your decision. Challenge the contract of donation through the court is very problematic, which entails additional costs. When making a testament, the picture is completely different: at any time you have the right to rewrite a document, add it or generally recognized invalid. In addition, relatives can appeal such a decision through the court and with the most likely to win the case.

If you summarize: Darisfactory is a cheaper and fast option, and the testament is rather a reliable and deliberate method of transferring property rights.

Download right now:

Sample testament;

Sample testament; Filled Property Test Samples;

Filled Property Test Samples; Sample testament with a visa chief doctor of a medical institution;

Sample testament with a visa chief doctor of a medical institution; Certificate from the notary on the secret of the execution of the testament;

Certificate from the notary on the secret of the execution of the testament; Darisal sample;

Darisal sample; Filled Sample Apartment Darment Agreement;

Filled Sample Apartment Darment Agreement; Sample Money Darment Agreement;

Sample Money Darment Agreement; Filled land duration agreement;

Filled land duration agreement; Sample car donation agreement.

Sample car donation agreement.

Remote registration

The procedure for issuing property to the inheritance entails documentary "Volokitu" on accounting and legitimate design. However, today there is an alternative ownership channel - through portal State Service. To do this, log on the site and through the quick search button find the option you want. This procedure does not take much of your time.

![]() Completed sample certificate of law on property inheritance You can download right now.

Completed sample certificate of law on property inheritance You can download right now.

Choose a gift or testament - the solution always remains yours. We hope that this article greatly facilitated your task for the selection of one or another method of transferring property to inheritance.