EGRUL is a single state register of legal entities. In this organization, you can get an extract - an official document that contains basic data on a legal entity. It can be useful when opening an account in a bank, with real estate operations, the certification of documents in the notary, with participation in the auction, so on.

To get an extract from the register, you need to write an application for its receipt, pay the state duty, submit documents to the tax. You can get this extract in the territorial tax inspectorate or in the registering tax (if the functions of registration of individual entrepreneurs and legal entities are assigned to one body). The application is compiled in free form, since the single sample is not provided. It is necessary to specify the name of the Juralice, his Inn, OGRN. In addition, you should write the name of the tax inspection, which the application is applied to, assure the document to print, sign up, put the date.

- name of the enterprise, organizational and legal form;

- actual, legal address;

- OGRN;

- information about the founders;

- the date of creation of the organization;

- types of economic activity;

- information on documents provided during registration;

- the size of the authorized capital;

- these persons entitled without a power of attorney to represent Jurlso (position, surname, name, patronymic, Inn, passport data);

- license data (if any);

- information about the presence of branches, representative offices.

All information contained in an extract from the register is publicly available. You can order an extract for any organization anyone, but for third-party persons, bank accounts and company passports will not be indicated.

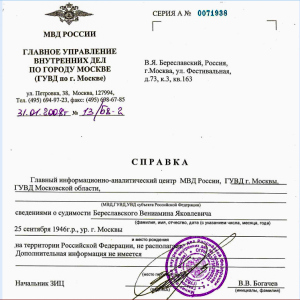

As written by the tax authority, it is not difficult to receive an extract, pay the state duty and all. Here we have in cooperatives and it turns out that the raider was issued an extract as a JUR. Person EGRULT AND FILELUSTE RIGHT IN THE COOPERATIVE, WITHOUT ADVERTISING AND CONVENTION DOCUMENTS, WITH ILLANT MANDATE PRINTY AND WITH PUBLIC DOCUMENTS. Tax Inspectorate No. 8 of Lukhovitsky District Molds Raiders. Modern Russian raidness is the actual independent view of highly profitable criminal activity, which is often organized (planned criminal activity, etc.) Separation of roles and conjugate with corruption abuses in law enforcement, judicial and non-governmental entrepreneurial environment. Communicative planned system Alien property. This is an extremely dangerous phenomenon on the abduction of someone else's property by illegal change in the right of ownership, using fraudulent actions. What does the provision of documents in the Tax Inspectorate No. 8 of Lukhovitsy, and the same extracts issues the tax inspectorate No. 17 of Lyubertsy, where Raiders appealed on the SNT "Oka", and even more so the act-exposure of documents from previous raiders and on what basis they use illegal printing. All those who have committed the crime fall under Article 169 of Article 327 and Article 303 of the Criminal Code of the Russian Federation, and tax inspectorates and other services who cover raiding under Article 262 of the Criminal Code of the Russian Federation. In conclusion, I want to say that the Cooperative of the SNT "Oka" was decorated according to the law "Country Amnesty", Ie, with the conduct of an interviewing with the receipt of cadastral numbers for 57 people and all documents were handed over and obtained from tax inspections No. 8 and no other related land users with us There was no and no, as Raiders wanted along with the tax authorities to conduct an illegal deal with another land plot of 1.0 hectares from a third-party organization. Moreover, all the courts who filed raiders were denied, including about the withdrawal of documents in 2012. Also the raiders were denied. Further, this is real corruption in the Moscow region and apparently, only with the arrival of the new governor of MO who can overcome this arbitrariness. In the Moscow region does not work, neither the police nor the prosecutor's office and all those services that are responsible do not know the Land Code in which everything is clearly spelled out.