As a rule, people associate the receipt of important documents with paper fiber. One of the relevant is the issue of certificate of certification number of the taxpayer (INN). However, it is not difficult to get it. According to the current legislation, this digital code is obliged to have not only every citizen of Russia, but also a certain category of foreigners. Consider what the specificity of the acquisition of the INN for this group of persons.

Definitions

The identification code is assigned to every person or organization operating in Russia to control the payment of taxes ( art. 84 NK RF). Note that this individual number is of great importance not only to streamline the taxation system, but also participates in many social and domestic events. For example, it is simply necessary for obtaining benefits and loans. Foreign citizens do not exception, if they are obliged to pay taxes and fees in the "KazNU" of the state. This indicates article 19 of the Tax Code of the Russian Federation. Since foreigners belong to individuals, the NC provides for the assignment of the INN.

Non-residents who are put inn

There are several categories of persons who do not have Russian citizenship, which have a tax number be sure to:

- overseas specialists working on the territory of the Russian state;

- foreign persons, constantly or temporarily living in the Russian Federation;

- legal entities and individual entrepreneurs from other countries with business in Russia.

In connection with the foregoing, we note that it is required to obtain the tax issue to all citizens of another state that:

- wish to arrange a patent for labor activity or work permit ( FZ №248 dated 07/23/2013);

- are owners of tax objects (vehicles, real estate, etc.);

- make operations or other actions falling for taxation.

Peculiarities of VAT

Although the tax number of the foreigner is almost indistinguishable from the INN Russian citizen, in the procedure of its preparation are some of the features. In addition to the mandatory documents, you need to provide:

- paper, confirming the registration of the place of residence;

- notarized translation of the passport;

- residence, the arrival form or a temporary residence permit (hereinafter - RVP) - depending on the situation.

On our website:

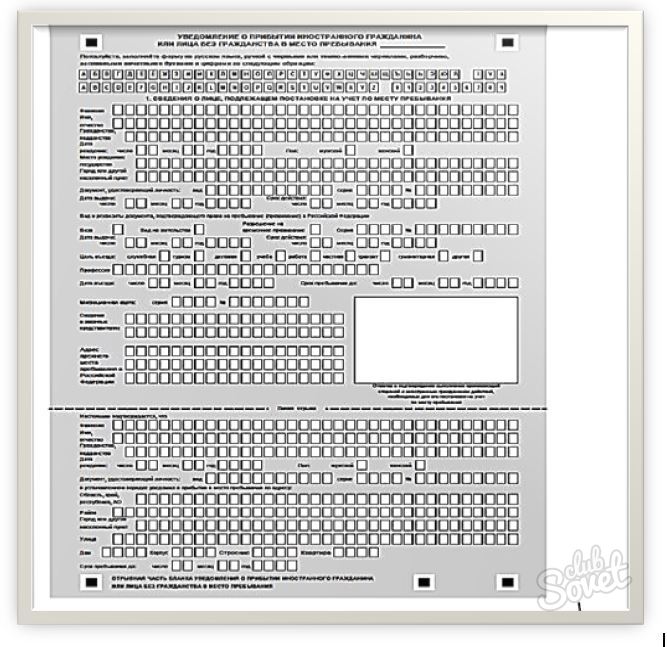

Blank notice of the arrival of a foreigner;

Blank notice of the arrival of a foreigner;- Sample completed form notifying the arrival of a foreigner;

Application form for alien registration at the place of residence;

Application form for alien registration at the place of residence; An example of an application for alien registration at the place of residence.

An example of an application for alien registration at the place of residence.

Basic documentation

Mandatory to provide the tax authority is invariably a set:

- identity document;

- application on form number 2-2-Accounting.

Download on our site:

- Form № 2- 2-Accounting (request form);

Form № 2- 2-Accounting (fill sample);

Form № 2- 2-Accounting (fill sample); Form filling rules № 2-2-Accounting (INN).

Form filling rules № 2-2-Accounting (INN).

where to go

The law states that the identification number is assigned and issued to the person at the place of residence ( art. 83 of the Tax Code). This rule applies to foreigners with ETA or residence permit. In the case where there is only a migration card - This documentation is supplied at the place of stay. Place of residence and the residence is a living room, which is fixed at a foreigner in the manner prescribed Federal Law № 109 "On Migration Registration".

So, to get a TIN, you must perform a few simple steps:

- To come to the tax office;

- Complete an application form prescribed form;

- Attach to it the required documents;

- To appear at the scheduled time for a certificate INN assignment.

A citizen of another country as well as the Russian citizen, a certificate identification number is issued within five days from the date of submission of the application. In general, for the group of persons the procedure of registration tax number is identical to that held all the Russian physical persons.

Hello, I zaregisrivan but registration is not renewed my patent Ploce timely but now banks are asking how to get a TIN TIN and patent registration is valid on the form the number of overdue

Good day! In the tax authority, the tax authority demanded that in the column "mark on confirming the execution of the host and foreign citizen of actions necessary to register at the place of arrival" stood a mark of the UFMS, and not LLC ",,,," where this citizen is registered. Is it legitimate?

Good day! I am a citizen of Ukraine, in 2014 issued a patent to work in Stary Oskol, that I needed to pick up the Inn in the tax did not know. Now I am in Adygea and when submitting documents for a residence permit, the certificate of the INN is required for a residence permit. Can I get that INN in Adygea without leaving, or need to make a new one or tell me another solution option? Thank you in advance!