This form of declaration varies very often, but all the basic information in it remains unchanged over long. Reporting quarters are as follows: 1 quarter, half year, 9 months or year. The declaration must be filled without blots and errors in the Excel program and printed. If you fill in a profit tax declaration with a pen, then make sure that the ink is black in it and do not be labeled, otherwise you will have to re-print and fill out the blank. The entire declaration consists of five blanks: the title page (it is the sheet 01), subsection 1.1 of section 1, sheet 02, Appendix No. 1 and No. 2 to the sheet 02. The remaining forms are filled only if necessary:

- Subsections 1.2 and 1.3 of section 1;

- Appendices number 3, No. 4, No. 5 to List 02;

- Sheets 03, 04, 05, 06, 07;

- Appendices No. 1 and No. 2 to the Declaration.

Learn from tax service employees which form you need to fill out.

How to fill the title list of income tax declaration

- In the first sheet of declaration, you specify personal data of your organization, as well as information about yourself. Fill in sequentially Inn, gearbox codes, as well as page number. The title leaf is always the number "001". Enter the year of the report, as well as two codes: the tax period code and the code of the region finding the enterprise. You can find out the classification of periods and territories on the Internet on the official website of the tax service of Russia or at the place of handling forms.

- The tax authority code you will also learn in your NWR at the place of residence. Enter the company's name, each letter must be placed in a separate cell.

- Code of Economic Activities Take from documents for registration of the enterprise. Enter your contact phone number with numbers "8" without spaces and blots.

- At the bottom of the page you need only its left part, as the right is intended for a tax service employee.

- Enter your surname, name and patronymic every word with a new line. After words, put dashing to the end of the cells. If the declaration is applied by the official representative, then the "2" digit fits in the top window. From the bottom necessarily the date and signature.

How to fill in a subsection 1.1 of section No. 1 for income tax declaration

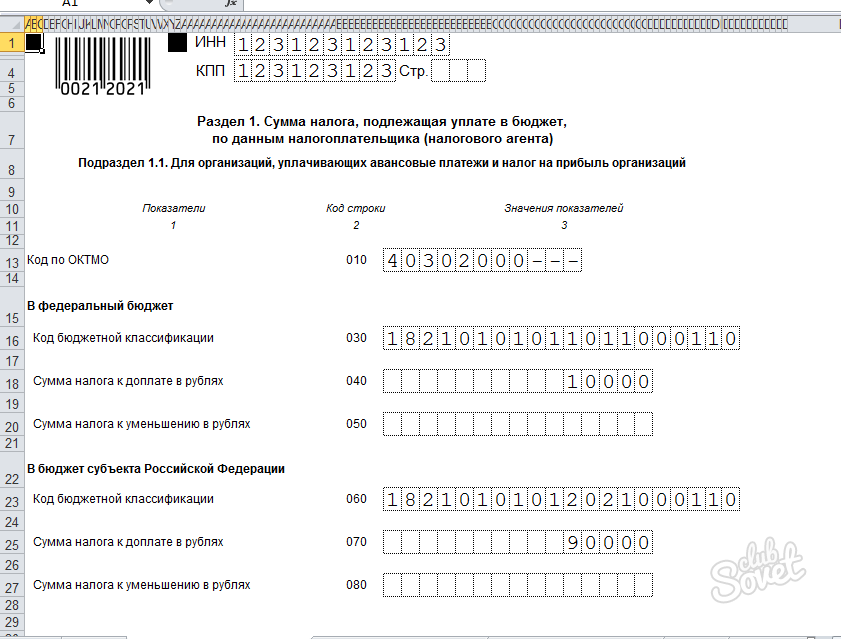

- At the top of the section also specifies the Inn, PPC and page number. This data you will contribute to the top of all sheets of the declaration.

- In line "010", specify the code of the municipality, on whose territory the company is based. Rows "030" and "060" are designed for the introduction of the CBK. The lines "040" and "070" are needed to calculate the amount of the surcharge, but divided into the budget.

- At the end of the page, put the date and signature. Without this, the blank will be invalid. Please note that black squares on the parties should remain intact.

How to fill in a subsection 1.2 of section No. 1 income tax declaration

- You choose between filling the previous section or of this. Together, sections 1.1 and 1.2 are not served. This form is designed for taxpayers who deduct the amount every month, and not in quarters or other periods. This is exactly the same information as the previous sheet.

How to fill in a subsection 1.3 of section No. 1 of income tax declaration

- Enter the Inn and PPC codes again, page number.

- If your company pays income taxes from dividends, then this sheet is mandatory for filling. In other cases, this subsection is skipped.

- Here are new lines: tax payments. You need to carefully write down all the amounts calculated from the profits for dividends and enter them into the righteous line.

- Compare all dates in the left column with the sums on the right. If you find a discrepancy, print a new sheet of subsection 1.3 and fill it up again. Errors in it are not allowed.

- The bottom is the signature and the date is mandatory.

How to fill in a profit tax declaration tax calculation

- In line 010, fold all sales revenues. The non-engine income you summarize and fit into the line 020, costs - 040, and in the 030 field, write spending related to the implementation.

- Losses that are not taken into account with taxation to enter into a string 050, if any. Row 060 is filled with a total amount of profit.

- All lines below you fill out purely individually, depending on the specifics of the enterprise. It is important to specify your valid tax rates in line 140 -170.

- On this page, the date and signature is not installed.

- This form continues on the second page, note that in the field "Page" You enter the next sequence number, despite the fact that the section is not finished.

- On this page you fill out the advance payment of the past payment period. In most cases, you will need to fill the lines 210 - 230 and 270 - 271.

How to fill in Appendix No. 1 to a sheet 02 income tax declaration

- On this form there is detailed details of income.

- In line 010, write down your entire revenue for the second quarter of the year, namely: 011 - revenue for the goods that you produce yourself. 012 - revenue for the goods you are pamping.

- The remaining lines are filled only when you have all the conditions for this, carefully read the description in the form.

How to fill out Appendix No. 2 to the sheet 02 income tax declaration

- Here you, on the contrary, specify your expenses. At the cash method, the rows 010 - 030 remain empty. If your company uses other methods, the lines are mandatory for filling.

- In the line 040, specify indirect costs, and in the following graphs, write them more detailed.

- This application goes on multiple pages, take into account this when filling out the page number at the top.

How to Fill Appendix No. 3 to List 02 Profit Tax Declaration

This application is filled only if your organization is in the reporting period:

- sold amortized property;

- selling outstanding debt;

- has costs of maintaining its production;

- has income and expenses under the trust management agreements;

- sales land purchased from 01/01/20 to 12/31/2011 inclusive.

You can download the full form of the form by reference: ![]() http://ppt.ru/upload/doc/d1.pdf.

http://ppt.ru/upload/doc/d1.pdf.